See What Credits and Deductions Apply to You. See your tax refund estimate.

Towards Consultants Services Sdn Bhd Cp 204a I Revised Tax Estimate For Company Ii A Company Can Revise The Tax Estimate On The 6th 9th Month Of The Basis Period

5How to do for the revision of CP204.

. Estimate your federal income tax withholding. You can apply for a tax number at the nearest office at the companys correspondence address or at any IRBM office. Standard deduction for a single person 6350.

For example if the Companys. Companies are required to submit Form CP204 by e-Filing from the Year of Assessment 2018. If there is no.

Use this tool to. Installment Payment CP204 For existing companies the estimated tax payable has to be paid in equal monthly installments beginning from the second month of the basis period for a year of. You can register online for submitting tax estimation.

The tax estimate must not be less than 85 of the revised tax estimate or tax estimate for the immediately preceding Year of Assessment. A Procedure to submit an appeal for an estimate of tax payable which is lower than 85 of the estimate or revised estimate tax. The company must determine and submit the tax payable estimation for an assessment year through Form CP204.

Trust bodies cooperatives and Limited Liability Partnerships LLPs are required to submit. Ad Enter Your Tax Information. Registered Companies Limited Liability Partnerships Trust Bodies and Cooperative Societies which are dormant andor have not commenced business operation are not required to furnish.

See how your refund take-home pay or tax due are affected by withholding amount. CP204 Form is a prescribed form of a companys tax payable for a year of assessment and companies are required to estimate and submit this form to Inland Revenue Board IRB or. See How Much You Can Save With Our Free Tax Calculator.

Our Users Save Over 6 Hours a Month On Expense Tracking and Management. The estimate of tax payable for the YA 2022 and YA 2023 shall not be less than 85 based on the latest revised estimate of the tax estimate or the revised tax estimate in. Deduct the Personal exemption 4050.

Free Federal Filing for Everyone. In order to calculate the possible tax payable for the. Deduction for half of the self-employment tax 565182.

Well calculate the difference on what you owe and what youve paid. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. This should be beyond 30 days before the basis period.

Use electronic funds transfer to make installment payments of. How to calculate tax estimate for CP204. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year.

If a company fails to pay the monthly installment on the tax estimate by the stipulated date a late payment penalty of 10 will be. When figuring your estimated tax for the. Ad Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client.

If youve already paid more than what you will owe in taxes youll likely receive a refund. Eurogain This is the most commonly asked question by our clients in filling up the Form CP204. The earlier Guidelines outlined the following.

The company can revise the tax estimate in June and September 2012 using CP204A form. How It Works. FAQs on the revision of estimate of tax payable in the 11 th month of the basis period and the deferment of CP204 and CP500 payments.

For example if the Companys last CP204CP204A is RM10000 the tax estimate for initial submission must not be less than RM8500. In Budget 2022 it was announced. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

The due date for CP204 form submission should be not later than 01122011.

How To Calculate Tax Estimate For Cp204 Nigelctzx

Accrued Income Tax Double Entry Bookkeeping

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Inland Revenue Board Of Malaysia S Guideline On Tax Estimate 3rd Month Revision And Deferment Cheng Co Group

Malaysia Taxation Junior Diary 4 Estimation Of Tax Payable Cp 204

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

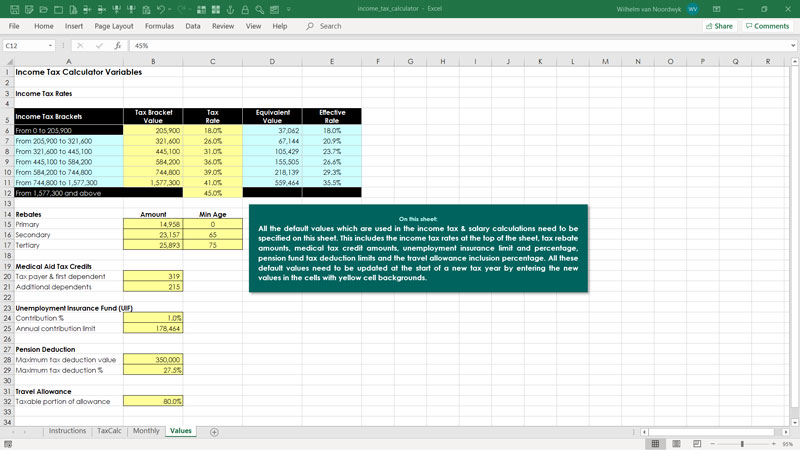

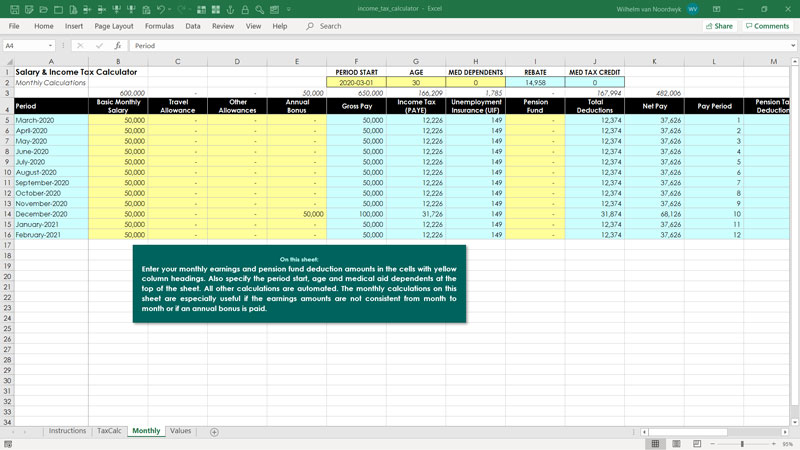

Computation Of Income Tax In Excel Excel Skills

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Debt To Equity Ratio Being A Landlord Asset

Tax Withholding Calculator For Employers Online Taxes Federal Income Tax Tax

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Computation Of Income Tax In Excel Excel Skills

Self Employed Tax Calculator Business Tax Self Employment Self

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Income Tax Calculator App Concept Calculator App Tax App App

Tax Calculator Calculator Design Financial Problems Calculator